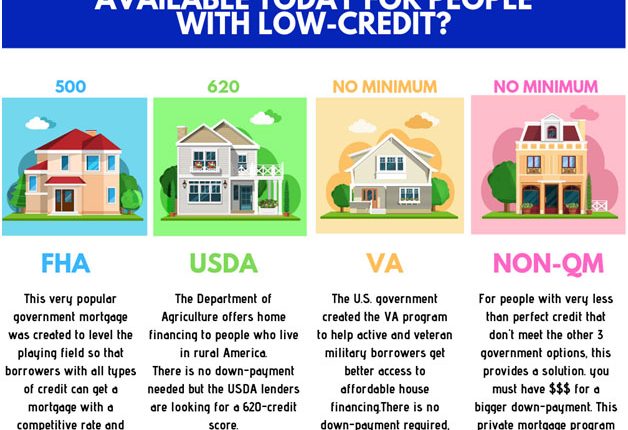

Can Borrowers With Less Than Perfect Credit Obtain 100% Financing For A Bad Credit Mortgage?

Unfortunately, in today’s America too many people have found themselves in a position of having less than perfect credit. On the other hand, many lenders are now using more lenient lending guidelines than in the past to approve borrowers with bad credit for a mortgage. As a result, even if you have bad credit, you may still be eligible for a home loan that covers a full 100% from the financing.

Below, I’ve listed a few suggestions that may help you get approved:

Online Mortgage Lenders

Remember, the lending industry is very competitive. Lenders are always looking for new customers and virtually all loan officers work on a commission rate and so if the loan does not go through they don’t get paid. As a result, it’s in their best interest to do whatever it takes to get you a loan – regardless of how bad your credit is.

Many online mortgage lenders specialize in bad credit borrowers and by contacting multiple lenders you will clearly increase you odds of not only getting a loan but ensuring that you get the best interest rate and loan terms possible.

Tip – Bad credit mortgage lenders have higher interest rates than traditional lenders that only loan to borrowers with good credit. As a result, it is advised that you survey the market well in advance, so that you may look for various bad credit mortgage packages and have the time to compare and choose the one that fits your current situation and budget.

Credit Report – Make Sure It’s Correct

Your bad credit may not be your fault. Mistakes by the primary credit reporting agencies do happen and so it’s always a good idea to get a copy of your credit. Ask for a copy of a tri-merged credit report from every lender you apply for a loan from. The reason you want a tri-merged credit report is because all loan decisions are based on the middle credit score and so if you only get a credit report from a single credit reporting agency it won’t accurately reflect you credit score. Plus, any discrepancies may only show up on one or two bureau reports and so you need a full credit report to verify that there are no mistakes. Of course , if you find an error make sure you dispute them immediately.

You may also want to check for old negatives. If you dispute these unfavorable items, you may be able to get them removed from your credit report. Sometimes collection agencies have moved your information around so much that the records are a mess. They may not even make an effort to challenge your dispute.

Cleaning up your credit report can quickly improve your credit, which will in turn increase your chances of getting a mortgage that has reduce rates and better loan terms.

Tip – Bad credit mortgages are a kind of secured loan which is usually secured against the house that you buy with the loan amount.

Interest Rates

Interest rates are constantly changing. Although they avoid bounce around quite as much in the Subprime market as they do in the retail (good credit) market they do and can change quite a bit. Therefore , pay attention to interest rates to determine when the best time is to apply for a loan.

Tip – Intended for options in finding the best lender for you, look at links below.