Auto insurance In Seattle At Affordable Rates

To get your car insured at the lowest price possible, you should be aware of some of the fact that can help you to find cheapest car insurance in Seattle. The easiest way to secure better rates to is usually have total knowledge of the factors that determine the vehicle insurance in Seattle. They basically enquire about the risk level that involves insuring your vehicle. The very first thing that any car insurance organization in Seattle notices is usually your typical commute time. If your commute time is usually shorter then your insurance of your car will be significantly less in comparison to the one whose average commute time is more.

If you are residing in an area where car accidents are reported frequently, then your auto insurance premium would likely to be affected. Another element that determines your car insurance in Seattle is car thefts. There have been approximate of 5, 780 automobile thefts were reported in 2007. And the list of stolen vehicles include Honda Accord, Acura Integra, Saturn SL, Honda Civic, Toyota Camry, etc . So , it is easier to get cheaper auto insurance in Seattle if you owe the car which is most likely to be stolen.

Other aspect that insurance companies consider that how much your automobile can uphold an impact. Insurance companies estimation the personal injury risk for your automobile. So , if you are going to buy a new vehicle, go through the nationwide studies and researches on how much your vehicle can sustain in crash test so that you can judge the vehicle from your insurer point of view.

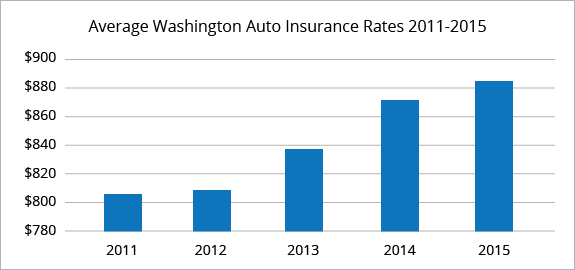

Car insurance rates in Washington are more than the national typical, so before going for it, it is suggested to evaluate quotes coming from various auto insurance providers in Seattle. As per WA legislation, the minimum car insurance you have to buy is usually $25, 000 (per individual), $50, 000 (per accidents) for bodily liability injury and dollar 10, 000 for house damage insurance. Remember, that car insurance in Seattle comes under state’s tort requirement i. electronic. if you are discovered responsible for the accident, after that car insurance organization would not be responsible for any restoration and accidental injuries that results. Furthermore, driving history, age, marital status, automobiles also determines car insurance in Seattle.

So , maintain all these items will going to decide auto insurance quotes in Seattle.